Black Friday. Black Thursday. Black Wednesday etc...

CNN Money: November 28, 2014

Consumption Zombies discarded the Thanksgiving holiday to gain a "headstart" on buying cheap junk that was equally available three weeks ago as it was on Thursday and Friday. Meanwhile, not once did they stop to consider all of the retail employees who forfeited their Thanksgiving as well, so that the Idiocracy could buy an Xbox at 2am on Friday. And suffice to say, none of these dumbfucks ever stopped to think about who actually makes all of this "merchandise" and why it is that Chinese factory slave wages are 1/10th the level of a Starbucks barista. That will be the Faustian Assumption made by this shrink-wrapped Idiocracy: No thought given. No thanks given. Never once thinking - "There, but for the Grace of God Go I".

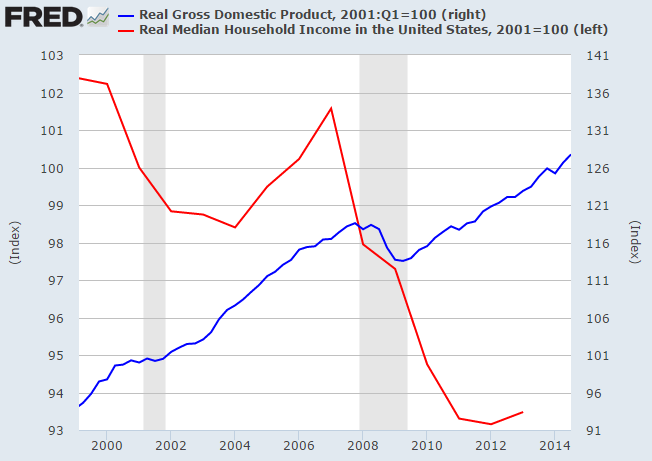

Which collapse are we waiting for anyway? Middle class incomes are down 10% in 15 years. Middle Class wealth is at a 20 year low. Sovereign ponzi debts are double what they were 7 years ago. Commodities are collapsing in real time. Globalization peaked in 2007. Most if not all financial commentators enjoy incomes and wealth levels that are orders of magnitude higher than the average family. Therefore, the typical commentator will be the last ones to personally realize that the "final collapse" is already well underway. The first step in reading ANY economic/financial article right now is to pretend that the collapse isn't already well underway, then proceed to hear about how it *could* happen at some distant and totally unforeseeable point in the future.

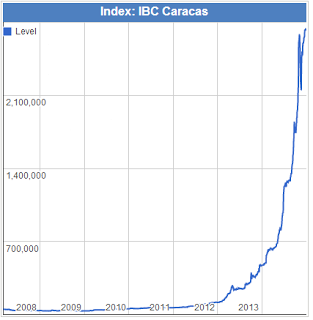

"Look Ma, no hyperinflation"

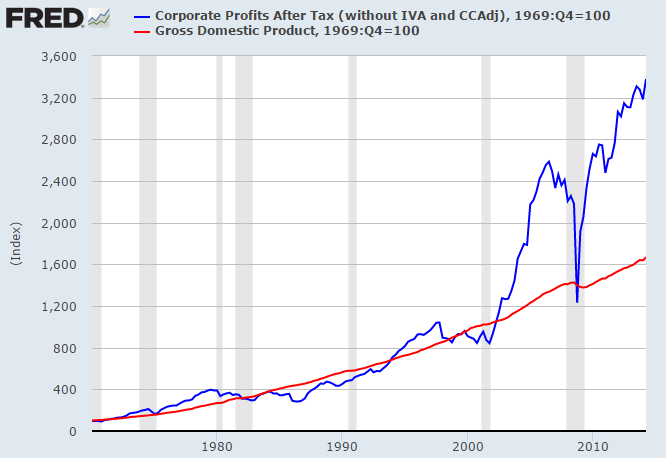

And for *some* reason, today's commentators seem uniformly incapable of acknowledging that Third World deflation is at the root cause of this fiasco, including the cheap capital emanating from Central Banks. The Money Supply grew 1,000% since 1980 while inflation fell the entire time. Cheap labour and cheap capital are compliments of Third World wage slaves. Central Banks are merely along for the ride:

Borrowing from Third World wage slaves

A recurring trade deficit axiomatically implies recurring borrowing

Federal Debt versus Net Exports:

Globalization Peaked in 2007, but let's just keep pretending that it didn't:

The Faustian Assumption: "It Can't Happen to Me"

It is.