The Yen (Dollar) has been clinging to the 120 level at all costs. A break below the two month range would be the last nail in the coffin...

"Risk-averse investors are becoming the nemesis of Japanese Prime Minister Shinzo Abe."

"The yen is the best-performing major currency this quarter...Options suggest there’s an almost even chance of a gain to 115 per dollar by Dec. 31"

“The BOJ is approaching the limit in doing quantitative easing and so is expected to reserve its powder for a more serious market rout in the future.”

The S&P (red) is clinging to the August lows:

Short-term, a critical divergence has emerged between the S&P 500 (red) and the Yen. Yen (Dollar) strength has prevented full fledged S&P meltdown...

Aussie / Yen (red) confirms the S&P:

To summarize, Aussie / Yen and S&P are lower, while the Yen / dollar is clinging to critical support...

Yen/Dollar Long-term: "Damocles' Sword"

...All while carry traders unwind their Yen shorts in size...

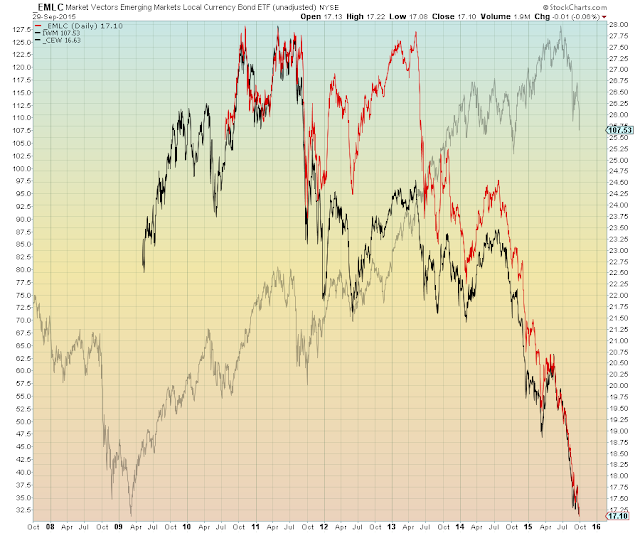

With Emerging Market Debt and Emerging Market currencies at multi-year lows:

I will go out on a limb and say that a "successful retest" of the August lows wouldn't look like this...

(Blue arrow shows August weekly low)