Finally someone in the lamestream media with a fucking brain. But it took until the VERY END to figure it out:

"We have come full circle. Globalization, until last decade the Left’s antichrist, is now the same thing but for the Right.

"We have come full circle. Globalization, until last decade the Left’s antichrist, is now the same thing but for the Right.

What made anarchists disfigure downtown Seattle in 1999 has now made Donald Trump disfigure American politics. In 1999, globalization was derided as a rich-world conspiracy to abuse the Third World, rob the planet’s riches and contaminate its air. In 2016, globalization is demonized as the poor world’s ploy to flood the West with immigrants and take abroad its jobs.

Trump, in other words, is not the zeitgeist’s cause; he is its result."

In summary, Globalization made everyone poor except Bill Gates & Co, something apparently the right didn't have the honesty and brain power to figure out until the very end. Too much Faux News will do that to you:

In summary, Globalization made everyone poor except Bill Gates & Co, something apparently the right didn't have the honesty and brain power to figure out until the very end. Too much Faux News will do that to you:

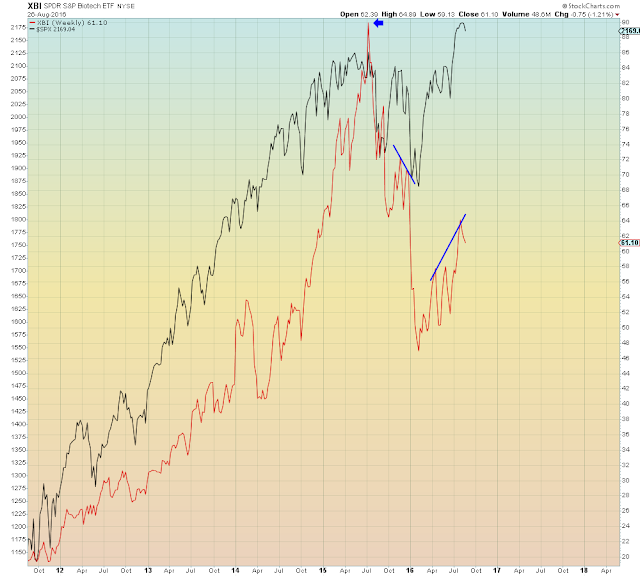

Nevertheless, they haven't thought this all the way through to their investment accounts. Yet...